Syria’s recent signing of a memorandum of understanding with U.S. energy giant Chevron and Qatar-based Power International Holding for offshore oil and gas exploration has reshaped the energy map of the eastern Mediterranean—and cast a harsh spotlight on Lebanon’s continuing paralysis in its own offshore sector.

The agreement, signed in Damascus and attended by senior Syrian officials and the U.S. special envoy to Syria, signals a major shift in international engagement with Syria’s energy sector following years of war, sanctions, and isolation. Coming shortly after the easing of Caesar Act sanctions and amid broader regional security discussions, the deal is widely seen as more than a technical energy arrangement. Analysts describe it as a political signal of renewed international confidence and a tentative “reward” for Syria’s new leadership under evolving regional alignments.

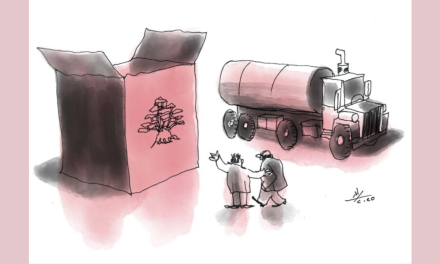

As Chevron expands its footprint across the eastern Mediterranean—operating in Israel’s Leviathan field and maintaining activities in Cyprus, Turkey, and now Syria—the company is effectively present in nearly every gas-producing or gas-prospective country surrounding Lebanon.

Lebanon, by contrast, is increasingly on the sidelines.

A Growing Regional Gap

Syria’s coastline lies between zones that have already witnessed major natural gas discoveries, making its offshore waters strategically attractive. With Chevron’s entry into Syrian waters, international energy players are clearly positioning themselves for the next phase of eastern Mediterranean gas development.

Lebanon’s offshore sector, meanwhile, remains limited to a consortium led by TotalEnergies, alongside Eni and QatarEnergy, with no U.S. energy companies involved. Despite signing exploration licenses and completing a maritime demarcation agreement with Israel, Beirut has failed to capitalize on regional momentum.

Industry observers say Lebanon is steadily losing both time and credibility.

Two Structural Showstoppers

At the heart of Lebanon’s stagnation are two fundamental obstacles that continue to deter major energy players and Gulf investors, many of whom are waiting for clear international and political signals before committing capital.

First: reform and administrative transparency.

Lebanon’s energy sector remains weighed down by weak governance, opaque decision-making, and slow regulatory processes. Despite repeated pledges, meaningful reforms—particularly in public administration, licensing clarity, and financial transparency—have lagged. For international oil companies operating in high-risk offshore environments, the absence of predictable governance and compliance mechanisms remains a major red flag.

Second: the monopoly of arms under the Lebanese state.

According to political and energy sources, the U.S. has effectively frozen progress on Lebanon’s oil and gas file pending a resolution of the Hezbollah weapons issue. The lack of a clear state monopoly over arms undermines investor confidence, complicates risk assessments, and raises concerns among Western governments and Gulf countries alike. These actors remain reluctant to advance large-scale energy investments without assurances that security and sovereign decision-making rest exclusively with the Lebanese government and army.

Borders, Trust, and Timing

Another unresolved issue is Lebanon’s northern maritime border with Syria. While Lebanese Petroleum Administration officials stress that international companies do not operate in disputed waters, the maritime overlap affecting Lebanon’s northern blocks remains a technical and political constraint. Sources have called for accelerating trilateral maritime demarcation talks between Lebanon, Syria, and Cyprus, amid reports of possible French-Saudi mediation efforts.

Yet even this file remains hostage to political timing.

As Syria positions itself—despite far greater structural challenges—as a new frontier for offshore exploration, Lebanon finds itself constrained not by geology, but by governance, security, and trust deficits.

A Closing Window

The contrast is stark: while Syria, emerging from conflict and sanctions, is attracting Chevron and signaling openness to international investment, Lebanon continues to miss opportunities due to political deadlock and unresolved sovereignty questions.

With regional energy investments accelerating and the eastern Mediterranean entering a new phase of development, Lebanon risks watching exploration and production move forward on all its maritime borders—while its own gas potential remains untapped beneath the sea.

Unless reforms advance, transparency improves, and the Lebanese state consolidates authority over security decisions, Lebanon’s offshore gas file is likely to remain frozen, even as its neighbors move decisively ahead.