There are few places in the world where you can witness a dog fight between Israeli and Syrian warplanes in the skies above a ski resort except perhaps in Lebanon. It was January 1973 when the incident occurred. The sound of a loud boom was followed by the sight of a fighter jet snaking down to crash just beyond the slopes of Faraya, a popular winter resort in Mount Lebanon. In the distance, the Lebanese ski brigade was slaloming down the steep ridge: yes, they had one such unit trained by a former Austrian officer turned restaurateur – make of that what you will.

That particular incident may have been forgotten but not the Arab-Israeli war that began a few months later in October that year, a conflict that redrew the map of the Middle East and is often associated with the Arab oil embargo of 1973.

Comparisons have been made with the current situation. But while the Arab oil embargo was instigated by the producing nations against Israel’s allies, the international sanctions against Russia and the EU oil embargo on imports of Russian oil were imposed by consuming nations against one of the world’s largest producers and exporters of oil, gas and coal (Oil Markets Brace For Russia Embargo). The Ukraine crisis has upset the global economy, stoked inflation, disrupted financial and energy markets (European Buyers Compete For Middle East Crude).

All these have been issues on the table this week at Davos, where the world’s movers and shakers are gathered to cogitate, debate and offer solutions to these multiple crises. Joining this elite group does not come cheap and this year, the price of admission has gone up to $250,000. That’s hyperinflation for you and forget about skiing. Several of Europe’s ski resorts have had to shut down for lack of snow because of mild weather. Even at Davos, only a few of the ski lifts are operating and just half of its slopes are open. That may be good news for European nations trying to conserve gas but not so much for the winter sports industry.

Whether this is due to global warming or not is still a matter of debate but these weather patterns are a reminder that the world is not on track to meet its climate goals and more needs to be done to step up deployment of clean energy. The IEA’s Executive Director, Fatih Birol, said in Davos that while environmental reasons remain the main drivers of renewable energy deployment, Russia’s invasion of Ukraine meant that energy security would drive investment further.

Tell that to the Lebanese, where there has been hardly any investment in reliable energy since 1975, when the country was plunged into a civil war from which it has never truly recovered. A 10th attempt to elect a president failed and the nation is practically bankrupt and has few friends, except former colonial power France. Beirut is pinning its hopes on finding gas offshore after the US brokered a maritime border deal with Israel (Total Readies Lebanon Drilling As Bidding Extended).

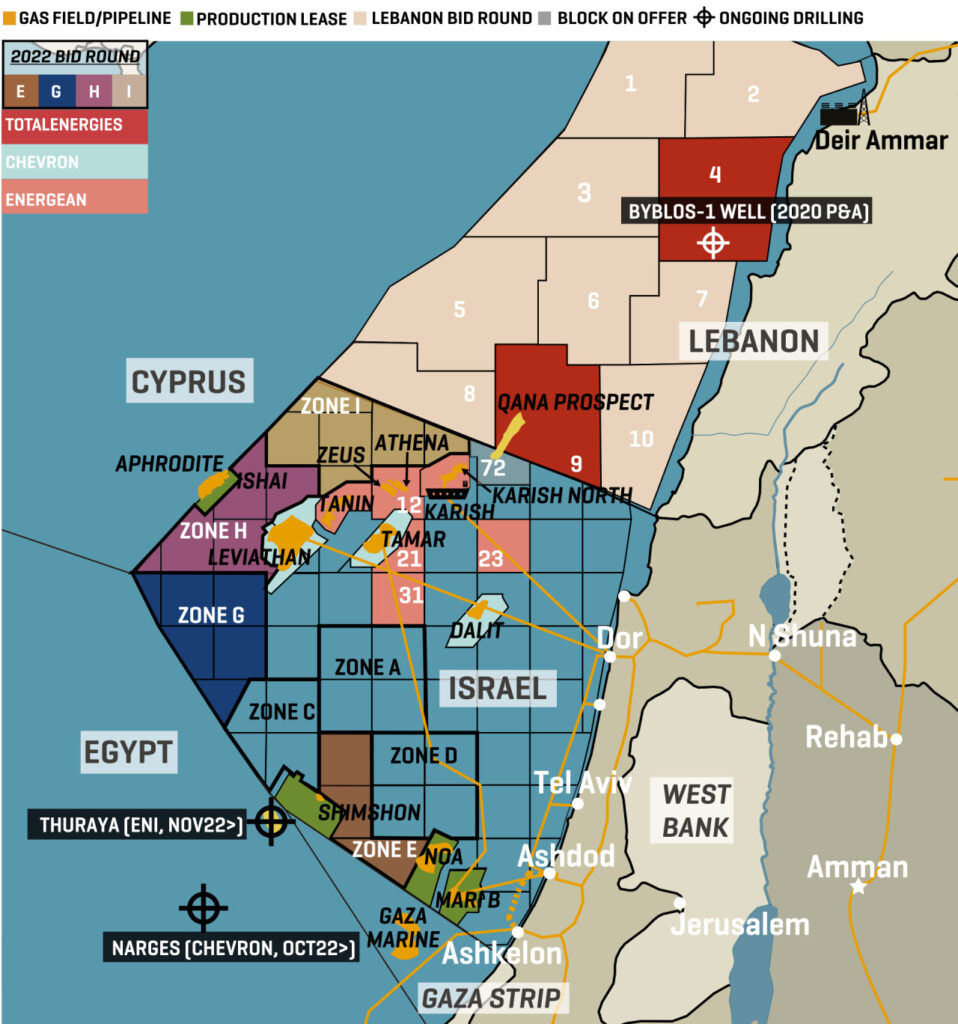

French major TotalEnergies announced on 12 December that it has mobilized a team to prepare drilling the Qana Prospect on Lebanon’s Block 9, with the aim “to complete the drilling as soon as possible in 2023.”

“The call for tenders to secure the drilling rig has been launched and should lead to a selection of the rig in the first quarter of 2023,” Total says. The French major has moved fast following ratification in October of the maritime agreement, with the Qana prospect thought to straddle the maritime border (TotalEnergies-Israel Deal Clears Way For Drilling Lebanon Border Field).

In November, Total (60%) and partner Eni (40%) announced that they had signed a deal with Israel outlining possible compensation if gas is ultimately discovered at Qana, opening the way for drilling to take place. Qatar state firm QatarEnergy also looks set to join Total and Eni at Block 9.

Total will be hoping that drilling at Qana will be more successful than its only other offshore Lebanon well, the Byblos-1 flop on Block 4 further north.

Both Lebanon and Israel, which on 13 December launched a bid round for substantial deepwater acreage including on the border with Lebanon (Israel Bids To Capitalize On Lebanon & Egypt Drilling, Europe Gas Demand Surge), will hope that their border deal spurs further exploration interest.

Lebanon had been due to close its own licensing round on 15 December. But on 8 December the Lebanese Petroleum Administration announced that the bidding deadline was being pushed back to 30 June 2023 citing “the completion of the demarcation of the southern border with occupied Palestine and the relaunch of petroleum activities in Block 9… especially the drilling of the first exploration well on this Block”.

Whether Lebanon will get lucky this time around will not be known for some time but even if gas if discovered, the country still has a mountain to climb.

MEES – By Kate Dourian, Contributing Editor – www.mees.com