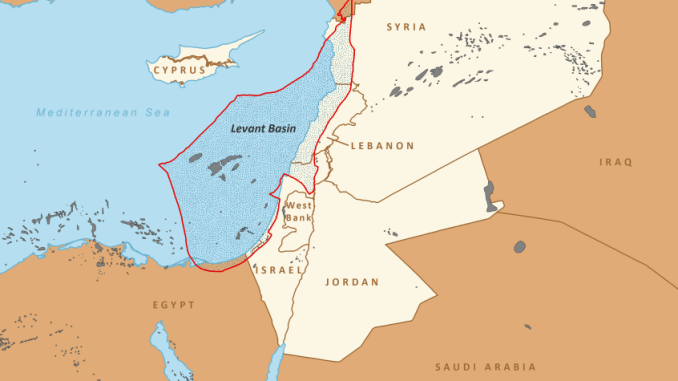

In February 2020, Lebanon announced the launch of exploration work for the first oil well off its coast. The prospect of hydrocarbon exploitation has created hope in the country hit by a deep economic crisis. In the summer of 2020, the results of the exploration activity were negative (block 4). This is a hard blow for Lebanon which is multiplying crises. Under the current conditions of the oil market, during the Covid-19 crisis, exploration expenses will be significantly reduced. This setback wards off Lebanon’s dream of joining the prestigious club of hydrocarbon producing countries.

The prospect of exploiting hydrocarbons in the Eastern Mediterranean gives rise to many hopes in Lebanon. This would revive the economy, create many jobs and join the club of oil and gas producing countries. However, even if Lebanon can exploit its hydrocarbons in a few years, the adventure will be very difficult for the country – in an already very competitive market.

The Covid-19 pandemic has brought the world economy to its knees, affecting the oil markets. The negative results of the exploration activity that Total group and its partners have carried out in Block 4 (Lebanese waters) constitute a further blow to Lebanon. Under the current oil market conditions, exploration spending has been reduced, delaying Lebanese oil production. The country cannot place any hope in the oil and gas sector to save its failing economy. “The Lebanese Center for Policy Studies” published an interesting article on the topic in May 2020 https://lcps-lebanon.org/featuredArticle.php?id=297

Main steps of an oil or gas field development project

The price of hydrocarbons has fallen gradually since 2014 due to overproduction on a global scale. The Covid-19 health crisis has led to a historic drop in demand due to the slowdown in global economic activity. There followed a collapse in oil and gas prices. This is bad news for Lebanon, where exploration activities have just started.

Worse yet, exploration of the first well did not yield any positive results. Under normal market conditions, this would not have been a major problem. But the market is now facing a major crisis, reducing Lebanon’s attractiveness for foreign capital. The negative results in Block 4 mean that investment will become more precarious in exploration activities – unless there is a radical change in the oil markets. Since Lebanon is a new market for hydrocarbons, and there has not yet been any solid result, investments there are all the more risky and uncertain.

Lebanon Economic Outlook?

Lebanon is hit by an economic and financial crisis – to which is added the health crisis and the Beirut blast, on August 4, 2020.

No discovery of oil or natural gas, regardless of the size of the reserves, could save the country from its current depression. Only a firm and sincere commitment in favor of deep economic reforms could get the country out of the different crises (political, economic reforms, international aid).

Despite the various challenges, Lebanon continues to dream of an oil and gas windfall that would open a new chapter for the country.

Alexandre Meeùs – Professional lawyer Involved in International Law, Diplomacy and International Organisations.